More Households to Shift into Protected Power Slabs by 2026

By Salman Khan

ISLAMABAD – Protected Consumers’ Share in Grid Electricity Sales is set to Surge by 2026 following commitment of Pakistan to International Monetary Fund (IMF) due to price based on incentives and reforms.

The projections indicate a major structural shift in electricity consumption patterns, with more households falling into protected slabs – a trend likely to be reinforced by tariff reforms and the CPP-to-grid transition process agreed with the IMF.Capacity Payments Drop, Relief for Consumers

Currency Converter

Analysts said that electricity sales to “protected” residential consumers are set to rise sharply over the next three years, backed by price-based incentives and reforms under the Government of Pakistan’s commitments to the International Monetary Fund (IMF).

As per the Letter of Intent and Memorandum of Economic and Financial Policies dated 24 April 2025, submitted to the IMF by the Government of Pakistan, the Ministry of Energy has “introduced forceful price-based incentives that engender a shift of CPPs to the grid” with the rationale to “promote uptake of electricity grid usage and incentivize more efficient use of energy sources.”

According to the submission, levy proceeds – the delta between the headline captive power plant (CPP) gas price and the baseline CPP gas price of Rs 3,500/mmbtu – will be transferred monthly to the electricity grid to reduce the average effective tariff and prices across the existing power tariff structure.

The government estimates an initial tariff reduction of Rs 0.90/kWh, with further cuts anticipated as the CPP levy increases through 2026. These subsidies will allow “front loading of reforms’ benefits to be felt by grid consumers” while longer-term structural cost reductions take effect.

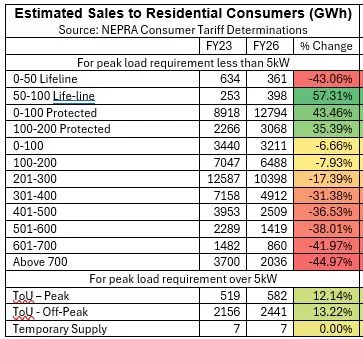

Fresh data from NEPRA’s Consumer Tariff Determinations shows the biggest jump in sales to protected consumers. Sales in the 0-100 protected category are projected to rise by 43.46% from 8,918 GWh in FY23 to 12,794 GWh in FY26, while 100-200 protected consumers will see a 35.39% increase from 2,266 GWh to 3,068 GWh.

The data shows that sales to consumers using 601-700 units are projected to drop by 41.97% (not 50.07%), while the 501-600 units category is set to decline by 38.01% (not 34.53%).

For peak load requirements over 5kW, Time-of-Use (ToU) consumers will see moderate growth, with peak usage rising by 12.14% and off-peak by 13.22%.