Pakistan’s Refineries Struggle Amid Levies and Export Losses

Pakistan’s refining sector is incurring heavy losses as outdated plants force exports of surplus fuel oil no longer in domestic demand

By Salman Khan

Karachi: Falling Fuel Oil Demand have Hit Refiners. Pakistan’s refinery industry is facing mounting economic pressure as obsolete technology limits its ability to shift away from low-value fuel oil (FO) production, according to a new Optimus Capital Management report.Market Gains Ahead of IMF Visit and Economic Review

Currency Converter

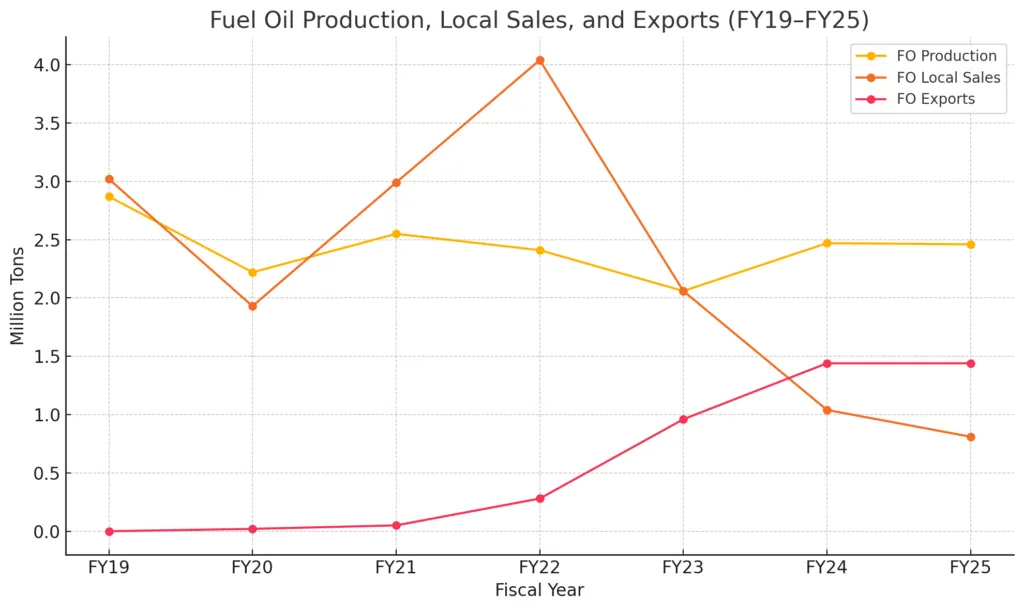

The study shows that while refinery throughput held steady at about 23% in fiscal year 2025, FO’s role in domestic power generation has plunged to just 0.4%, down sharply from 7.4% in FY19. With domestic consumption collapsing, refiners have increasingly turned to exports — often at a loss.

Government Levies Deepen Losses

The report warns that recent government levies — including a Petroleum Development Levy (PDL) and Carbon Surcharge Levy (CSL) totaling PKR 82,000 per ton — will make FO sales even less viable locally. This is expected to further swell loss-making exports.

NEPRA and OCAC data show FO exports jumped from 0.02 million tons in FY20 to 1.44 million tons in FY25. Over the same period, domestic sales collapsed from 4.04 million tons in FY22 to just 0.81 million tons in FY25.

Call for Urgent Refinery Upgrades

Industry analysts say the only sustainable solution is investment in refinery upgrades to shift output toward higher-value products such as gasoline and diesel. Without such modernization, the report warns, financial strains will intensify and place further pressure on Pakistan’s economy.

“The challenges underscore the urgent need for refinery upgrades across the energy sector,” Optimus Capital Management stated in its findings

Energy experts note that Pakistan’s outdated refining base has been a recurring concern for over a decade, with modernization projects repeatedly delayed. Without immediate action, analysts fear the sector will remain trapped in a cycle of low-value output and rising losses.